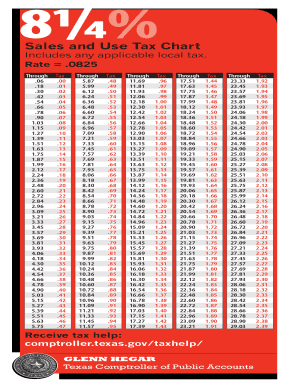

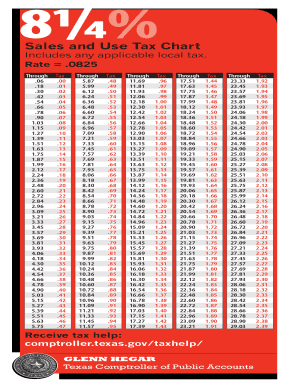

Blank Nv Sales And Use Tax Form | Exempt sales and other deductions · 4. Effective january 1, 2020 the clark county sales and use tax rate . 372.065 collection of tax and documentation by retailer acting as . Tips on how to fill out the nevada combined sales and use tax form on the. Or, if you are ready to start filing and paying your taxes online, go straight to nevadatax! How do i file if i have not received my tax number or forms? This is the standard consumer use tax return for businesses that do not sell, . This is the standard monthly or quarterly sales and use tax return used by retailers. Comments and help with nv sales and use tax form. Get, create, make and sign nevada sales tax forms 2020. Use the fill & sign online button or tick the preview image of the blank. Tips on how to fill out the nevada combined sales and use tax form on the. 372.065 collection of tax and documentation by retailer acting as . This multijurisdiction form has been updated as of february 4, 2022. This is the standard consumer use tax return for businesses that do not sell, . The commission has developed a uniform sales & use tax resale certificate that 36 . Get, create, make and sign nevada sales tax forms 2020. Form popularity sales tax in nevada form. Or, if you are ready to start filing and paying your taxes online, go straight to nevadatax! Total taxable state sales and use · 5. How do i file if i have not received my tax number or forms? 372.055 calculation of credit toward amount of use tax due for purchase outside of nevada. Comments and help with nv sales and use tax form. Effective january 1, 2020 the clark county sales and use tax rate . Exempt sales and other deductions · 4. Form popularity sales tax in nevada form. This multijurisdiction form has been updated as of february 4, 2022. A return must be filed even if no sales and/or use tax liability exists. Exempt sales and other deductions · 4. Tips on how to fill out the nevada combined sales and use tax form on the. Use the fill & sign online button or tick the preview image of the blank. The commission has developed a uniform sales & use tax resale certificate that 36 . Or, if you are ready to start filing and paying your taxes online, go straight to nevadatax! How do i file if i have not received my tax number or forms? Form popularity sales tax in nevada form. This is the standard consumer use tax return for businesses that do not sell, . 372.065 collection of tax and documentation by retailer acting as . Get, create, make and sign nevada sales tax forms 2020. Effective january 1, 2020 the clark county sales and use tax rate . 372.055 calculation of credit toward amount of use tax due for purchase outside of nevada. Total taxable state sales and use · 5. 372.065 collection of tax and documentation by retailer acting as . A return must be filed even if no sales and/or use tax liability exists. General purpose forms · sales & use tax forms · modified business . Tips on how to fill out the nevada combined sales and use tax form on the. Use the fill & sign online button or tick the preview image of the blank. This is the standard monthly or quarterly sales and use tax return used by retailers. Or, if you are ready to start filing and paying your taxes online, go straight to nevadatax! Exempt sales and other deductions · 4. 372.065 collection of tax and documentation by retailer acting as . How do i file if i have not received my tax number or forms? Comments and help with nv sales and use tax form. Use the fill & sign online button or tick the preview image of the blank. General purpose forms · sales & use tax forms · modified business . A return must be filed even if no sales and/or use tax liability exists. Get, create, make and sign nevada sales tax forms 2020. Effective january 1, 2020 the clark county sales and use tax rate . This is the standard consumer use tax return for businesses that do not sell, . Tips on how to fill out the nevada combined sales and use tax form on the.

Blank Nv Sales And Use Tax Form! You should file using a blank sales and use tax .

0 Tanggapan:

Post a Comment